IMF Loan –The Conditions for Restoring Confidence

By Prof Janek Ratnatunga

Much has been written about the pros and cons of Sri Lanka seeking an IMF bailout. Currently, from where the country stands, there appears to be no alternative solution. Sri Lanka has already turned to other governments for assistance, especially China, India, and Bangladesh. Currency swaps have been tried; assets have been sold or leased. Other assets are on the block for sale. All of this has been of no avail.

It now appears that Sri Lanka has been cornered to such an impossible situation such that it has no option but to “commence negotiating at the barrel of a gun.”

However, who will do the negotiations for Sri Lanka? With all of the Cabinet and the Governor of the Central Bank resigning today, it will most likely be a caretaker government.

If the IMF is willing to negotiate with a caretaker government (a big ‘if’), it is surely going to place significant conditions prior to bailing out Sri Lanka. This article will argue that whatever economic conditions are placed on Sri Lanka it will not be enough; and that unless the IMF places conditions insisting on fundamental reforms of Sri Lanka’s democratic intuitions, it will only be ensuring that the country can just survive.

The Role of the IMF

The IMF was created in the wake of World War II to manage the global regime of exchange rates and international payments. Unlike the World Bank, which was designed as a lending institution focused on longer-term development and social projects, the IMF was conceived as a watchdog of the monetary and exchange rate policies vital to global markets.

Since the collapse of fixed exchange rates in 1973, the fund has taken a more active role, intervening in debt crises in both developed and developing countries, and responding to the Covid-19 pandemic-induced economic crisis.

The fund has received both criticism and credit for its efforts to promote financial stability. Some economists cite its vast expansion of lending capacity, governance reform, and the move away from free market fundamentalism as significant positives. However, critics say that the IMF must go even further in implementing changes that will improve the plight of the world’s poor and guarantee the fund’s relevance in a changing global economy. These critics say that the conditions the IMF attaches to its loans are too harsh and have seriously harmed developing countries.

The IMF is akin to a credit union that permits its membership access to a common pool of resources—funds that represent the financial commitment or quota contributed by each nation, relative to its size. In theory, members with balance-of-payments trouble seek recourse with the IMF to buy time to rectify their economic policies and restore economic growth. The fund pursues its mission in three fundamental ways: (a) surveillance; (b) technical assistance; (c) lending.

Last week, the IMF Surveillance Report of Sri Lanka was released - monitoring the financial and economic policies of the country and offering macroeconomic and financial policy advice. As this report has been analysed in great detail by qualified economists in this and other newspapers, I will not dwell on this.

Of more interest to all in Sri Lanka is its ‘Lending’ mission: i.e., to give loans to member countries that are struggling to meet their international obligations.

IMF’s Poor Record

Loans, or bailouts, are provided in return for implementing specific IMF conditions designed to put government finances on a sustainable footing and restore growth. Known as “structural adjustment,” these policies have included balancing the budget, removing state subsidies, privatizing state enterprises, liberalising trade and currency policy, and removing barriers to foreign investment and capital flows.

Sounds good? Will it show some light at the end of the tunnel?

Not unless these conditions go hand in hand in restoring CONFIDENCE in the country’s democratic institutions.

Whilst the IMF has been credited with great success in its interventions in eurozone economies, and in Mexico and East Asian countries in the mid-1990s, its record in severely impoverished countries, particularly in Africa, Latin America, and South Asia, have been seen as overly ambitious and intrusive, and resulting in a country being in a more catastrophic situation that before the intervention.

In his 2002 book, Globalization and Its Discontents, Nobel Prize–winning economist Joseph Stiglitz denounced the fund as a primary culprit in the failed development policies implemented in some of the world’s poorest countries. He argued that many of the economic reforms the IMF required as conditions for its lending—fiscal austerity, high interest rates, trade liberalization, privatization, and open capital markets—have often been counterproductive for target economies and devastating for local populations. Many of the fund’s loan conditions and technical advice has been seen as out of touch with ground-level realities.

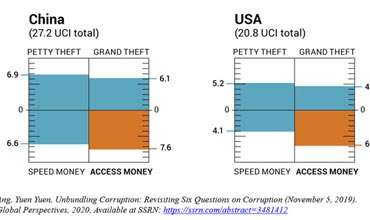

Why is it that, by and large, the IMF has had good success with developed countries, and abysmal success with its interventions in some of the poorer countries? My hypothesis is that it is due to the lack of independent democratic institutions in these counties that results in endemic corruption by those in power.

The IMF cannot force its will on member countries; countries accept the fund’s conditioned financial assistance on a voluntary basis. The ‘lending conditions’ placed by the IMF are supposedly designed not only to guarantee the repayment of loans but also to ensure the money borrowed will be spent in line with the stated economic objectives. But these ‘lending conditions’ do not insist that there are independent democratic institutions in place to ensure that there is proper accountability and transparency in how the loans given are spent. Without such institutions, a percentage of the loans will find its way for political rather than economic objectives. At worst, it will be siphoned out to slush funds controlled by those in power. The IMF lists ‘improving governance and fighting corruption’ as one of the conditions for structural adjustment, and in Sri Lanka this can only be achieved by ensuring the independence of its democratic institutions.

Primary Democratic Institutions

What are the primary institutions of democracy that ensure proper accountability?

There are three primary democratic institutions – Legislature, Executive and Judiciary. All must be independent of each other both in form and in substance.

In all democracies, the Legislature is an assembly of elected representatives which exercises supreme political authority on behalf of the people. The legislature passes the laws of the country.

In most democracies, the Executive is made up of two categories: (a) the Political Executive and (b) the Permanent Executive (or Public Service). The Political Executive is elected by the people for a specific period. Political leaders who take the big decisions fall in this category and are voted in or out at elections. In contrast, the Permanent Executive consists of public servants who are ideally well qualified for their job and are appointed on a long-term basis. Public servants remain in office even when the ruling party changes. This means that the Governor of the Central Bank, the Commissioner General of Inland Revenue, the Auditor General, the Bribery Commissioner, the Securities and Exchange Commissioner and other key positions should not be political appointees.

Finally, an independent and powerful Judiciary is considered essential for democracies. All the courts at different levels in a country put together are called the judiciary. The judicial system in Sri Lanka comprises the Supreme Court, the Court of Appeal, the High Court, and the District, Magistrates’, and Primary courts. Unfortunately, in Sri Lanka, these have been heavily politicised for decades, no matter what party is in power.

Institutional Reform as a Condition of Bailout

Why does the IMF not ask for institutional reform along with economic reform as a condition of giving a loan?

The IMF will probably argue that this is not part of their Charter, and that anyway political reform of a country’s democratic institutions can be only via its legislature. This, of course, is the normal process in a democracy.

However, the situation in Sri Lanka is so dire that all CONFIDENCE has been lost in its financial structures. There are horror stories that foreign exchange sent to Sri Lanka cannot be taken out again. This loss of confidence is evident from the recent behaviour of Sri Lankan workers overseas avoiding remitting hard earned dollars from overseas, and the reluctance of those being enticed with high interest rates to open Inward Investment Accounts (IIAs). Individuals can withdraw only limited funds from their NRFC accounts. Foreign Direct Investments (FDIs) by overseas companies are virtually non-existent. All this is due to a lack of confidence.

The resignation of the Cabinet and the Governor of the Central Bank will certainly not increase confidence until more is known of the composition of the caretaker government. Further, if key positions in the executive and judiciary continue to be political appointees then conditions precedent for the endemic corruption that has plagued the country will remain.

Thus, if the IMF truly has Sri Lanka’s interests in mind, then it will insist on the institutional reform required for restoring confidence in the financial and economic structures, prior to a bailout being approved. This can only happen if the country’s democratic institutions are truly independent and free of political manoeuvring. The IMF could place a condition that the caretaker government passes resolutions in Parliament to ensure such independence, prior to the bailout being approved. In fact, the IMF’s latest review of conditionality, completed in 2018, recommended improving transparency and evaluating IMF programs in a timelier manner. This can only be done with independent democratic institutions.

It must be recognised that the IMF is routinely identified with economic hardship and political ferment because it is only in times of crisis that its services are sought. It is often the only organisation equipped for such interventions and consequently, the only one with the power to place conditions in a holistic manner, both institutional reform and economic reform.

If this is not insisted upon, Sri Lanka will soon be level-pegging with Pakistan as to the country with the largest amounts of IMF bailouts. Perhaps this is what the IMF wants – for Sri Lanka to just have its nose above the water, and never actually be able to swim ashore.

-

Still No Comments Posted.

Leave Comments