Sri Lanka economic crisis – A tale of Meltdown

By a Special Correspondent

Some friends wanted a simpler explanation on the brief on 2022 [4]: economic crisis. This note explains the origin and the role of the various regimes in managing the foreign exchange crisis. Footnotes, which can be skipped, give a more detailed explanation and some historical context.

Nowadays, dollar shortage is a widely used term. The dollar deficit occurs when earnings on exports of goods and services plus remittances are less than payment on imports of goods and services. The difference is called the current account [C/A] balance.

In the past two decades the C/A balance has always been negative and was less than -$2.5 billion it most years [FN1]. How did we finance this deficit year after year as dollars cannot be printed unlike rupees?

The two main stable sources for dollar financing are:

- Foreign Direct Investment [FDI].

- Net project disbursements: equal to the difference between money we receive yearly on projects funded by donors and amortization dues on loans taken in the past.

These two inflows never exceeded $2.2 billion in any year over the last two decades [FN2]. This net positive receipt and a moderate depletion of foreign reserves were sufficient to finance C/A deficits whenever the latter were not too large.

However, persistent high oil prices in any year resulted in large C/A deficits. They could not be financed in this way and as a result those were years of balance of payment [BOP] crisis.

Oil prices were high in 2000, 2008 and 2011-2014, and these were years of major shocks to the economy. In 2000 & 2008 the government was compelled to seek IMF financing to avoid a BOP crisis.

From 2007 to 2014, the same duo who headed the Presidential Secretariat and the Central Bank until recently raised external commercial foreign loans [CFL] with IMF’s tacit support to drive growth. It’s difficult for Sri Lanka or for that matter any developing country to access international markets without IMF backing.It raised a large amount of CFL by floating International Sovereign Bonds, opening up the domestic debt market for hot flows of foreign money and using National Savings Bank/BOC to float bonds effectively guaranteed by the government [FN3].

2011 to 2014 were ‘oil-crisis years` with C/A averaging around -$5 billion. CFL raised during this period helped stave off a severe foreign exchange crisis but the rupee funds generated were frittered away on government consumption [FN4].

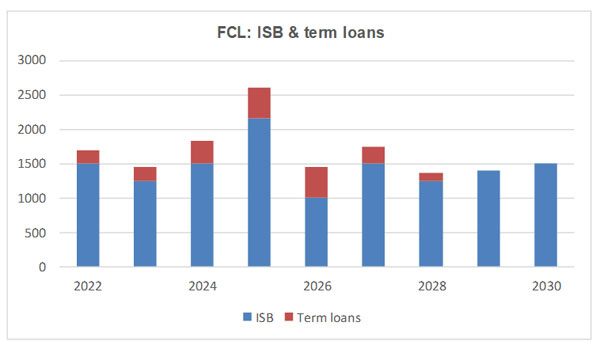

Large loan repayments on CFL averaging $1.5 billion every year had to be paid back from 2015 onwards. It has to be either refinanced (i.e., rolled over) or funded by generating adequate C/A surpluses and through large inflows of FDI. The ‘stop-go’ populist policies of two consecutive regimes effectively precluded the possibility of achieving such a surplus [FN5].

Sri Lanka therefore faced a rollover crisis every year from 2015 onwards while previously the crisis was intermittent: these were really years of oil shocks. Moreover, in 2018 and in 2021-22, Sri Lanka confronted a twin crunch: BOP crisis because of high oil price shock as well as the continuing rollover crisis.

Economic and media narratives have asserted that a Chinese ‘debt trap` and/or massive gross debt payments of $5 to $6 billion/year are the main reasons for the foreign exchange crisis.

Chinese project loan disbursements have been greater than loan amortization payments in any year in the past. Hence, those project loans cannot be the reason why Sri Lanka is facing a grave foreign exchange crisis today. [FN6]

The gross debt payment includes gross debt amortization on (a) CFL, (b) project loans, and (c) dues of CBSL/IMF/banks/private sector. There are also continual capital inflows from the latter two entities. Thus, it is the net disbursement that matters to assess repayment risk of each category. Net disbursement on projects has constantly remained positive. Because of tight restrictions imposed by the Central Bank, external borrowings of the commercial banks/private sector are marginal. The residual CBSL/IMF transactions do not pose a significant risk. Thus the major risk is the repayment of CFL and not the gross debt repayment figures frequently cited in various commentaries [FN7].

The 2015-2019 regime, lacking a coherent strategy to tackle the rollover crisis, went on a foreign commercial borrowing spree right from the word go [FN8]. Its singular achievement in this regard was to ensure that amortization payments on CFL would be spread more or less evenly from 2023 to 2030 with bullet payments of $1 billion or more in each year. In other words, the pain would come in equal doses for an entire decade. [FN9]

The new regime of 2019 had to contend with the rollover crisis from the day it assumed power. It claimed, however, that by boosting foreign currency reserves via (a) increased tourism earnings, (b) a significantly higher level of foreign direct investment (FDI) inflows for financing various activities, including port city development, and (c) a greater volume of credit from India/China, it could avert any projected foreign exchange crisis. But the Covid-19 pandemic, which struck the island in March 2020 ruined regime’s plans. Tourism earnings shrunk abruptly and port city/FDI dipped because of strict exchange control measures introduced beginning in April 2020. A further blow was that very little of the Indian or Chinese lending could be utilized for CFL repayment as most of it was tied loans, with the foreign state creditors extracting detrimental concessions through non-transparent negotiations [FN10].

Emerging signs of a dollar shortage faced by industrialists and others widely reported in the press from the second quarter of 2021 were passed over with flimsy excuses. Macroeconomic blunders listed in 2022 [4]: economic crisis unquestionably aggravated the foreign exchange crisis. The final nail in the coffin was the oil price hike compounded by a steep fall in remittances in 2021. The economy went into a tailspin with foreign reserves nearly drying up by the end of the year. It was inevitable that the government would default in 2022 as the external shock gradually intensified due to higher prices for oil, food & other commodities from end-2021 and due to the sheer size of the CFL repayment commitments in 2022.

By repaying a total of $3.3 billion on CFL from 2020 to the first quarter of 2022, the government severely aggravated the foreign currency crisis. If the regime had from the very inception recognized the gravity of future CFL repayments and initiated measures to access international markets or pursued alternative funding mechanisms with IMF assistance, it could have avoided the economic calamity that has currently come to pass.

In summary, the regime of 2007-14 effectively spawned this crisis by relying significantly on CFL to finance unproductive government expenditure. The Yahapalana regime`s crippling reliance on CFL as well, combined with poor macroeconomic management on the whole, intensified the crisis. The catastrophic failure of the current administration, which has been in power for a little over two years, in attempting to manage the economy by way of `home grown` remedies has resulted in a first-time debt default.

Sri Lanka must now go through painful negotiations especially with tightfisted international creditors on CFL loan repayment since it constitutes the largest and the riskiest component of foreign debt. The following are three important points to note for driving medium-term growth and debt sustainability: (a) without sizeable debt-write offs on CFL the country’s ability to grow will be markedly impaired; (b) government’s initiatives on radical reforms [what are these concrete measures?] especially on the fiscal front; (c) CBSL’s commitment to keeping the current undervalued exchange rate as more or less a permanent feature [FN11].

We are witnessing a `shortage economy` that reinforces itself: rolling blackouts, endless queues, and a bewildering array of supply-chain bottlenecks, as Sri Lanka is highly import-dependent on all types of raw materials, essential consumer items, and investment goods. A million households in poverty, a country in social and political turmoil demanding reform, a political class unwilling to relinquish power, a feeble opposition incapable of articulating the immediate needs of the people – we seem to have reached an impasse in parliament that is unable to reach a consensus on how to distribute political power via an interim administration that can safeguard the poor, stabilize the economy and stimulate growth. A challenging task indeed!

FN1: All data are given in absolute amounts. To be realistic deficits should be measured relative to GDP for each year. C/A was less than -3% of GDP for most years.

FN2: Inconsistent policy/political environment for attracting FDI and weak project implementation stalled any prospect for realizing a higher figure to bridge the gap.

FN3: A synopsis of history of raising CFL is given in:

Sovereign bonds and term loans are, in fact, commercial loans. These have to be repaid in 10 years or less, usually with high interest rates ranging from more than 6% for 10-year bonds to about 5% for 5-year bonds and term loans.

Unless there is sustained increase in export earnings or foreign direct investment (FDI), or a radical change in government policy, Sri Lanka is likely to sink deeper into a debt trap – a classic case of rolling over of existing commercial loans by borrowing in the international market every year for the coming decade.

The top-most wizards (or charlatans) at the Ministry of Finance and Central Bank cooked up three novel ways of commercial loan financing of the Government Budget from 2007. These are first, by raising funds from international market via sovereign bonds; second, by opening up the domestic bond market to volatile money flows from foreign investors; and third, by urging the National Savings Bank (NSB) and Bank of Ceylon (BOC) to borrow foreign money ostensibly for lending to the private sector. But the bulk of these funds were invested in domestic treasury bills/bonds, thus indirectly financing the budget.

The senior bureaucrats’ rationale for this type of commercial borrowing was that traditional domestic market borrowing could not be increased much more without increasing interest rates and that project funding by multilateral agencies and foreign governments were bound by their rules and regulations. Flexibility in funding the budget and augmenting foreign reserves to meet any shortfall in balance of payments were the other purported goals. The implicit assumption was that the economy would grow fast enough to meet future debt obligations arising from high-cost commercial borrowing.

Commercial loans in excess of US$10 billion were raised during the 2007 to 2014 period. This became the dominant form of budget funding in most years during that period. More than three-quarter of the budget is usually allocated for recurrent expenditure. Money is fungible: flexibility in funding was really a ploy to spend scarce foreign money largely on current consumption – unproductive spending of the worst kind.

Although Sri Lanka had a temporary economic boom during the early years of the previous Mahinda Rajapaksa Government, the country’s reliance on commercial loans for unproductive expenditure could not deliver sustained growth.

FN4: Sri Lanka recorded an `impressive` average growth of 6.4% during the 2007-14 period. However this debt-fuelled growth was fragile as the three key drivers fell apart or reduced significantly after 2012. These were:

- Additional budgetary financing from the newly sourced CFL of $10 billion mainly for government consumption

- A substantial increase in remittances of $4 billion from migrants mainly for private consumption

- Large increase in project disbursement of about $5 billion for infrastructure procured mainly from China.

Exchange rate depreciated at about 2.5% while prices, as measured by GDP deflator, were rising at an average of 8.4% during this period; a sure sign of emerging macro difficulties mainly because of persistent overvalued exchange rate.

FN5: All administrations professed export driven-growth as priority. In reality an overvalued exchange rate together with expansionary fiscal policy at most times, and at times loose monetary policy, stifled all possibilities of the country reaching a positive C/A surplus or of attracting a significant amount of FDI.

FN6: Chinese project loan portfolio is estimated at $3.5 billion out of a total government external debt of $32.7 as of end 2020. Repayment period ranges from 15 to 20 years. The so-called Chinese debt trap is ideological fiction generated in the Western media since debt amortization is less than $0.3 billion/year for outstanding loans over the next two decades. However economic viability of some projects financed by China and other lenders is questionable – Mattala airport is an egregious example.

FN7: Even `scarier` figures of gross debt service dues of $6 to $7 billion are usually cited. However this includes interest payment of about $1 billion. By definition C/A balance includes interest payment.

From the onset of CFL crisis, the net payment by banks/private sector has fluctuated between -$0.5 billion to $0.4 billion. Although there are large swings in CBSL transactions on swaps with foreign banks and the Asian Currency Union, these do not pose a significant risk on debt payments. IMF payment commitments are small.

Interest payment on CFL amounted to $0.9 billion in 2019 and in 2020 - a sure sign that Sri Lanka was reaching its limits on additional borrowing in the capital markets.

FN8: The exploits and repercussions of the 2015-2019 Regime on CFL are summarized in the extract from a previous article below:

“A huge commercial debt hangover of about US$10 billion was left to the incoming administration [2015-2019] to sort out. The Government has rightly emphasized the role of exports and FDI to put the economy on a sound footing and reduce the impact of the debt crisis. But its piecemeal approach to promoting exports and FDI has not helped the economy to recover.

“However, the current Administration while continuing to lambast the Rajapaksa regime on the huge debt crisis on every platform has pursued the same policy of raising foreign commercial loans willy-nilly. The portfolio of commercial loans increased from US$10 billion in 2014 to about US$15 billion by the end of 2018. It has remained a major form of budget funding from 2015 to 2018. As it now stands, the repayment schedule from 2024 to 2028 will be a minimum of US$1,500 million per year, an onerous burden for any prospective Government. By pursuing myopic short-term goals, both the current and previous Governments have mortgaged Sri Lanka to international lenders to the hilt.

“The noise emanating from the Central Bank recently is also not encouraging. It appears the CB will be seeking new commercial loans from a range of sources including sovereign bonds, negotiating lines of credit through State Banks, and calling for Panda and Samurai bonds! The corrosive ‘sugar-high’ urge to go for high interest commercial borrowings closely mirrors the failed strategy of the previous Government, pushing the country further into the debt abyss.”

During the 2015 to 2019 period, the borrowings and repayments of CFL amounted to an average of $3 billion and $1.4 billion per year respectively. As a response to high oil prices and large outflows of foreign money from the bond market in 2018, CBSL recklessly borrowed $4.4 billion in the international market in 2019.

CBSL apparently didn’t grasp the downside of excessive borrowing during 2015-19 period: an appreciating exchange rate hindering exports and so-called `soft` budget financing from rupee proceeds of CFL is a way of kicking the can-down-the road, i.e., leaving it to future governments to tackle macroeconomic imbalances.

FN9: Scheduled CFL repayments of international sovereign bonds [ISB] and Chinese term-loans from 2022-2030 are shown in the graph below:

FN10: Chinese term-loans worth $2 billion with maturity period 7 to 8 years in 2018, 2020 & 2021 are primarily spent on term-loan repayments. Swaps from bilateral lenders, unless continuously extended year after year, are really short-term loans - an impractical approach for repaying CFL.

FN11: Indian Minister of Finance recently requested IMF/WB to consider giving Sri Lanka temporary classification as a lower-income country to help it restructure its debt. It is quite possible that per capita income will sink below $3,000 in 2022 since the exchange rate is projected to well over Rs. 300/$ - a very steep fall in income from $3,800 in 2014 [see graph in 2022 [2]: economic stagnation].

-

Still No Comments Posted.

Leave Comments